In addition being able to transfer money to India with Money2India under low exchange rates, ICICI Bank has partnered with Vodafone mPesa LTD to enable Vodafone subscribers send and withdraw money using m-pesa on their mobile phones.

Money2India is an inexpensive online money exchange solution that rides on ICICI bank’s wide network in India, where the bank has over 2,600 branches. Money transfer to India using the ICICI Money to India system is secure and convenient.

One can transfer money very fast to relatives and friends in India. Upon receiving the money, the recipient can use Vodafone M-pesa to pay utility bills, and shop online using Vodafone bill payment online facility.

Mobile money payment has fewer regulations as compared to bank accounts transactions. Mobile money also attracts lower charges, and is more convenient to use. Lower Mpesa charges, safe transactions and ease of use (even for people who do not have a bank account) are the main reasons for the huge growth of mobile payment platforms in India and Africa.

How to Transfer Money to India with Money2india

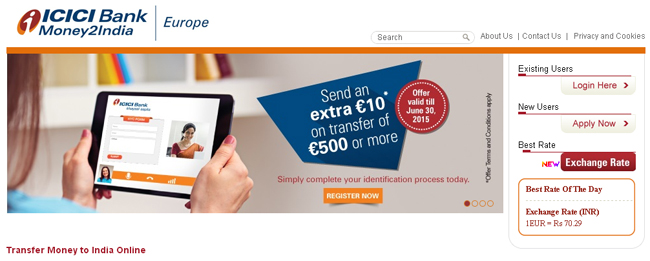

To transfer money to India with Money2India, a European resident needs to create an account with Money2India Europe.  This is a one-time registration that enables you to begin sending money online. The money transfer system has competitive rates and you know the exact amount of rupee the recipient will receive by using the Money2India charges calculator.

This is a one-time registration that enables you to begin sending money online. The money transfer system has competitive rates and you know the exact amount of rupee the recipient will receive by using the Money2India charges calculator.

Money2india Exchange Rate

The Money2India exchange rate is lower than regular bank charges. Users of the money transfer to India solution can select between two transfer modes, INSTA Net Express and Net Express. Net Express and INSTA Net Express are available in over 17 countries in the Eurozone, including Germany, Australia and UK.

Money2India electronic transfers can be done to over 200 Indian banks that have more than 80,000 branches. To transfer money to India using the Net Express mode, users can opt for the Fixed Rupee transfer that has a fixed exchange rate until the expiry of the validity date.

Money2India users can also remit money to any Visa Debit card used in India. Fixed Rupee Transfers allow an exact transfer of money to India whereby you enter the exact amount you want the receiver to get, and the system works out how much you need to send. Another benefit of using the popular remittance service is the ability to track your transaction online and receive e-mail updates.

Same Day Money Transfer to India

Using the Money2India service to transfer money to India bank account takes up to 3 business days. Use the Money2India INSTA Net Express payment mode for faster transfer of money to any Indian bank account, within one business day.

Same day transfers work for any transfer that is transacted before 1100 hrs (CET), and users are given an assured transfer rate. Assured transfer rate means the Money2India exchange rate does not change once the transfer is initiated – until the transaction is complete. Same day money transfer to India has no transaction fees and the same-day service works for all banks in India.

Withdraw Cash with Demand Draft

In addition to the electronic Money2India money transfer modes to ICICI bank account, other banks in India and electronic transfer to a Visa Debit Card issued in India, you can also send money to India using a Demand draft that a recipient can use at over 3000 demand draft locations in India to receive instant cash. Money2India is one of the cheapest and convenient ways to transfer money to India.

Share On Your Favorite Social Media!

Use the following links to spread the word...